The Effect of Mobile Banking on the Financial Performance of Commercial Banks in Bangladesh

The Effect of Mobile Banking on the Financial Performance of Commercial Banks in Bangladesh

Bipul Kumar Sarker1, Debobrota Kumar Sarker2, Shompa Rani Shaha3, Deepongkor Saha4, Saurav Sarker5

1Lecturer, Department of BBA Professional, Habibullah Bahar College, Dhaka-1000, Bangladesh

2Managing Director & CEO, SouthAsia Research & Corporate Advisory Ltd, Dhaka-1000, Bangladesh

3Investment Specialist, SouthAsia Research & Corporate Advisory Ltd, Dhaka-1000, Bangladesh

4,5Technical Advisor, SouthAsia Research & Corporate Advisory Ltd, Dhaka-1000, Bangladesh

Publication Information

Journal Title: International Journal of Research and Scientific Innovation (IJRSI)

Author(s): Sarker,Bipul Kumar; Sarker,Debobrota Kumar; Shaha, Shompa Rani; Saha,Deepongkor; Sarker, Saurav

Published On: 04/29/2025

Volume: 11

Issue: 2

First Page: 482

Last Page: 494

ISSN: 2321-2705

Cite this Article Sarker,Bipul Kumar; Sarker,Debobrota Kumar; Shaha, Shompa Rani; Saha,Deepongkor; Sarker, Saurav; The Effect of Mobile Banking on the Financial Performance of Commercial Banks in Bangladesh, Volume 11 Issue 9, International Journal of Research and Scientific Innovation (IJRSI), 482-494, Published on 04/29/2025, Available at https://rsisinternational.org/journals/ijrsi/articles/the-effect-of-mobile-banking-on-the-financial-performance-of-commercial-banks-in-bangladesh/

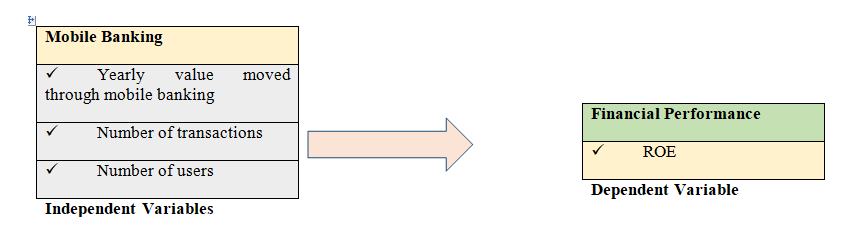

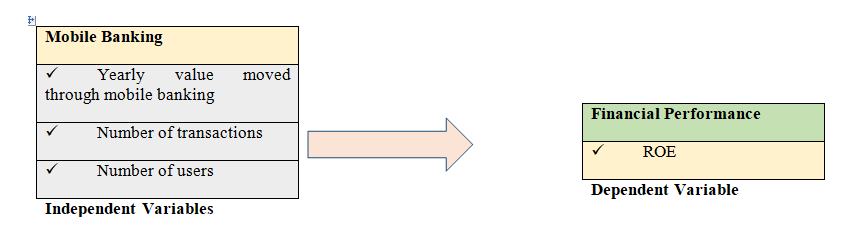

The purpose of this study was to investigate the relationship between the growth of mobile banking and the financial performance of Bangladeshi commercial banks. The focus of the study was to clarify the mobile banking tactics used by commercial banks, evaluate their present financial situation, and identify how mobile banking impact their economic performance.

The research design for the study was a descriptive survey. A census of all 13 of the commercial banks registered at Bangladesh Bank was conducted. The Central Bank of Bangladesh’s bulletins and financial statements covering the years 2018 through 2023 provided secondary data for the study. Using the statistical software for the social sciences (SPSS) version 26, descriptive statistics including mean, standard deviation, maximum, and minimum were utilized to examine the data and identify important patterns and sample features. After that, correlation analysis and a multiple regression model were used to evaluate the connections between the parameters.

The study comes to the conclusion that the quantity of transactions and the number of mobile banking users have grown to be significant factors in the financial performance of Bangladesh’s commercial banks. Nevertheless, the quantity of transactions has no significant impact on the commercial bank’s financial standing in Bangladesh.

The study leads to the execution that, despite a number of obstacles that must be overcome by cooperation amongst stakeholders, mobile banking is essential to improving the financial performance of commercial banks in Bangladesh.

Keywords: Mobile Banking, Financial Performance, Multiple Regression Model

Copyright © 2023 Gyaanarth.com